2024 Schedule C Form+Irs

2024 Schedule C Form+Irs – Some gifts that a small business owner gives to their employees may be taxable, while others are not. Here’s how to know the difference and understand record-keeping requirements and best practices. . That could provide a break to some taxpayers on their taxes in 2024. The tax agency on Thursday said it’s adjusting the tax brackets upwards by 5.4%, relying on a formula based on the consumer .

2024 Schedule C Form+Irs

Source : turbotax.intuit.com

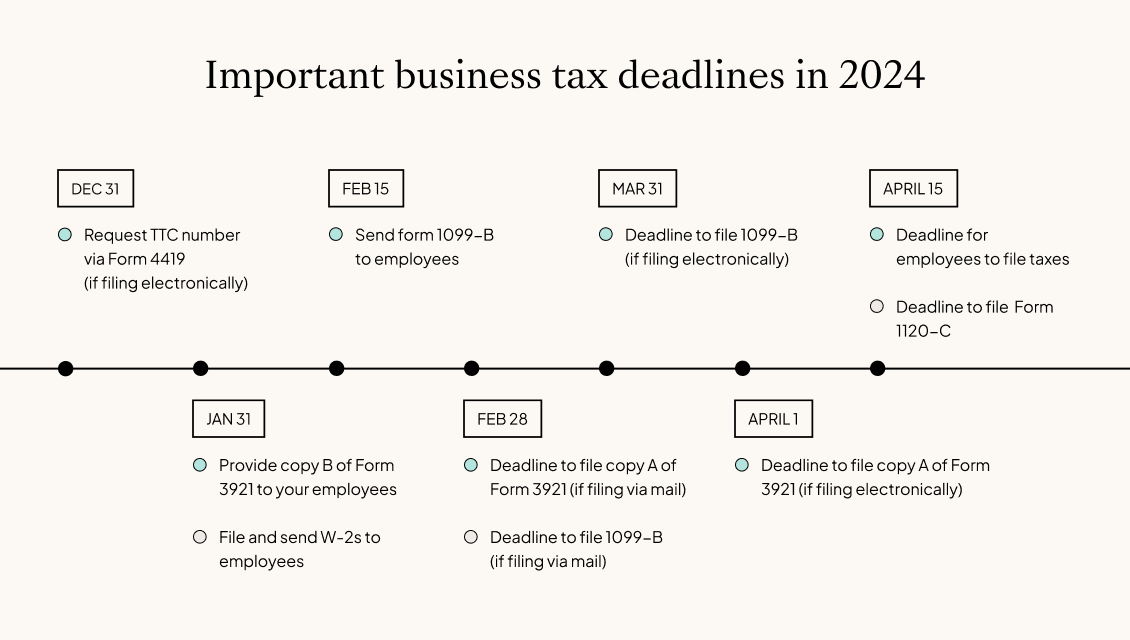

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

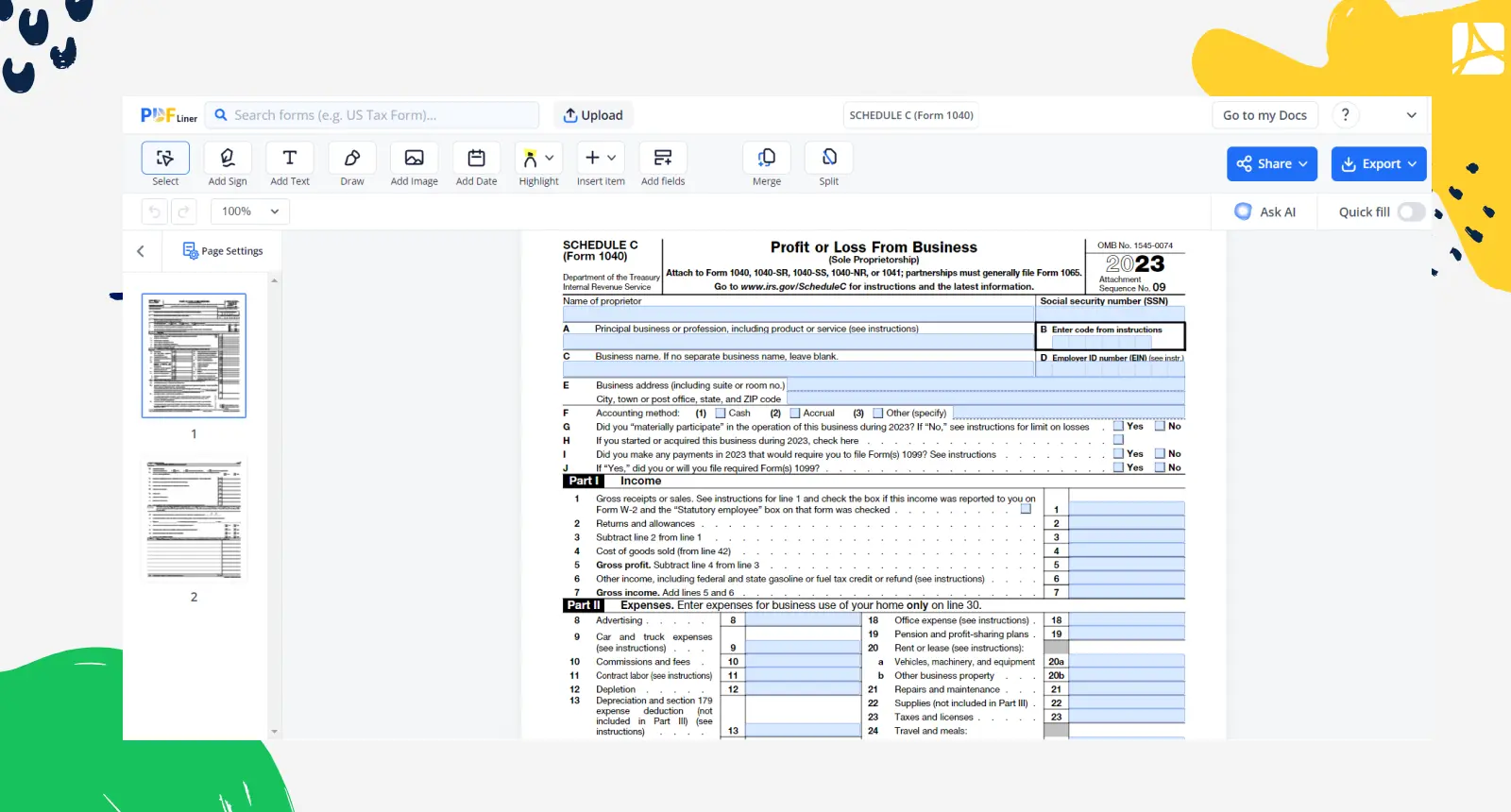

Taxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com

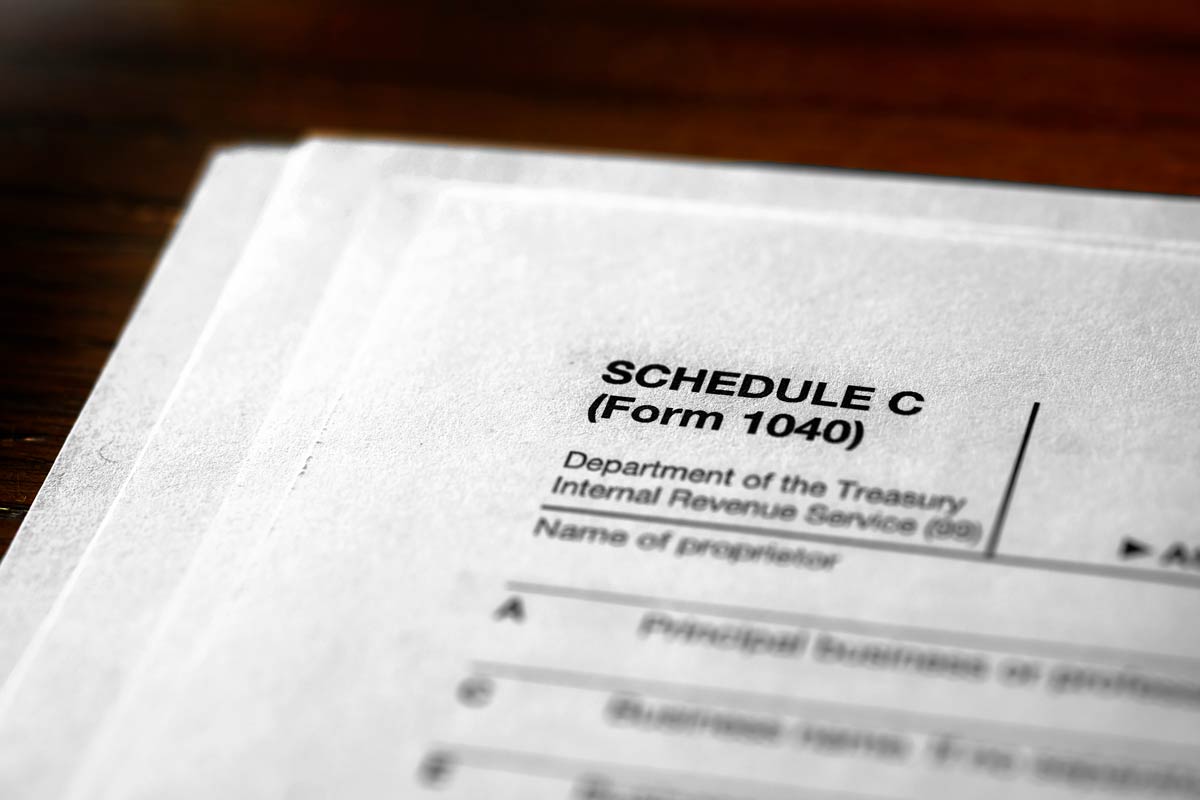

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

BSB Associates | Hauppauge NY

Source : www.facebook.com

Schedule C Filers Now Eligible for Larger PPP Loans Wegner CPAs

Source : www.wegnercpas.com

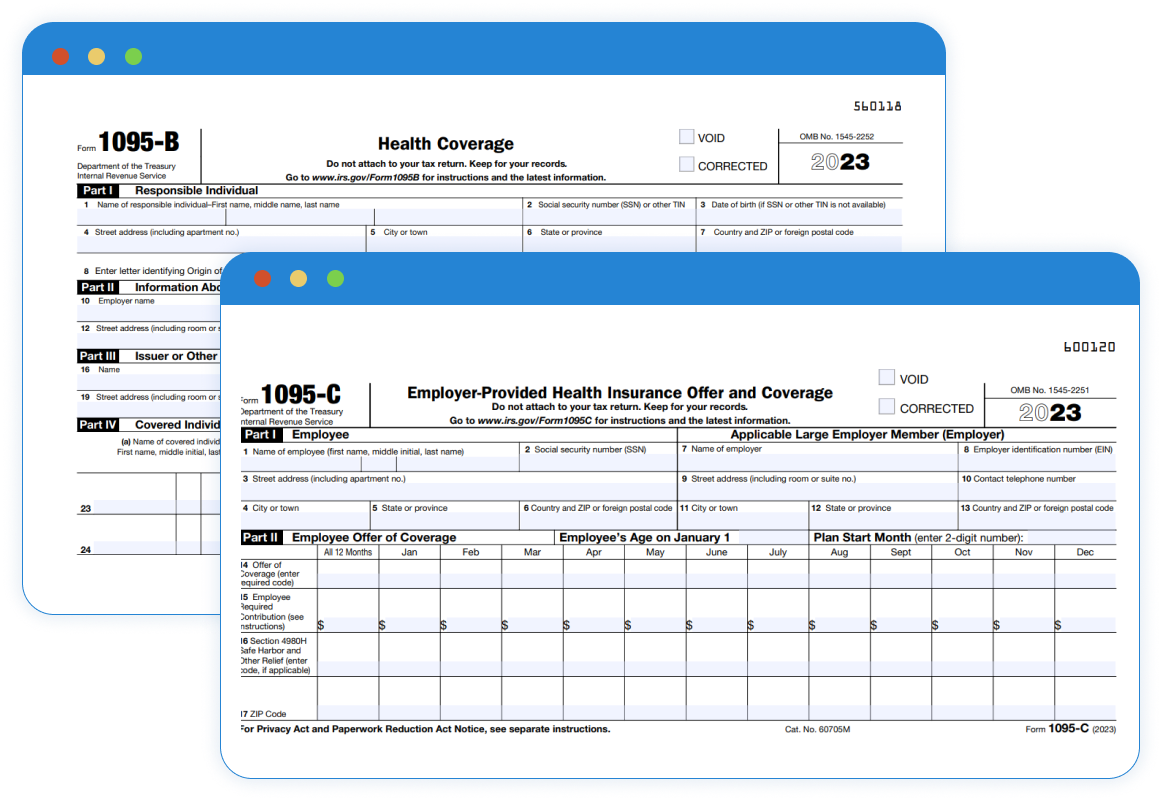

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

Tax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com

L&P Tax Pros

Source : m.facebook.com

2024 Schedule C Form+Irs What Is a Schedule C IRS form? TurboTax Tax Tips & Videos: Note that the provided schedule is approximate, and changes may occur. Any modifications will be promptly communicated through the Commission’s website. Regular updates regarding the estimated . The information on that document can help you to fill out Schedule E (or C). Schedule a flat rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more. .